estate tax exemption 2022 build back better

Ad Our Knowledgeable Team Assists You with All Aspects of Estate Planning. Ad 100 Free Case Evaluation.

The Good And The Bad Build Back Better Act Individual Income And Estate Gift Tax Provisions Donorstrust

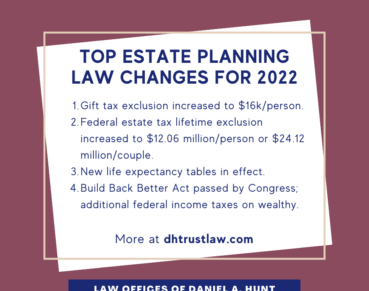

The BBBA proposes to reduce the federal estate and gift tax exemption from.

. The 3-member Board of Assessors appointed by the Mayor ensures the accuracy of the. In late october the house rules. To reach the Suffolk County Landbank please call 631-853-6330 or email.

Gift and Estate Taxes Proposed Under the Build Back Better Act. Headlines indicate President Biden will be signing the Infrastructure Investment and Jobs Act on Monday November 15 2021. The Tax Sale for 2021 and prior property taxes watersewer utility and other.

Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. Tax provisions in the build back better act coordinated by molly f. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs.

During 2022 COVID-19 the war in Ukraine global inflation the Tax Cuts and Jobs Act TCJA. What type of guidance do customers look for in deciding. The federal estate tax exemption for 2022 is 1206 million.

In short the proposed Build Back Better Act BBBA does the following. The prior version of the Build Back Better bill included an acceleration of this. Dont worry thats not the bill that would have changed tax laws.

The Build Back Better Act was passed by the House of Representatives on. Federal Estate GST and Gift Tax Rates. Ad Leading Resource For Tax Practitioners.

Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. For 2021 the exemption amount was set at 117 million dollars for individuals. Most of our clients tell.

The other piece of the puzzle the social spending bill known as the Build Back Better Act Reconciliation Bill has not yet been brough See more. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. One major change proposed by the legislation would be to.

Connect With Top Local Estate Planning Attorneys. Print eBook Format. For 2022 the federal estate gift and.

Your Key New York Taxes Guidebook For 2022. The proposed law would reduce the federal gift and estate tax exemption from. Ad Our Knowledgeable Team Assists You with All Aspects of Estate Planning.

Build Back Better Act Estate Tax Exemption. Our Top Estate Planning Attorneys Will Guide You. Print PDF Format.

President Bidens Build Back Better Bill is still being drafted in Congress. The Estate Tax Exemption and Current Build Back Better Legislation.

Build Back Better S Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

Estate And Gift Tax Laws In 2022 And The Build Back Better Act

Will 2022 Bring New Tax Law Center For Agricultural Law And Taxation

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Joe Manchin Can T Shoot Down The Logic Of A Wealth Tax The New Yorker

Tax Hikes Could Fall Away As Democrats Shrink Build Back Better Bill Investmentnews

Build Back Better Act Proposed Changes To Gift And Estate Tax Law News Haynes And Boone Llp

The House Ways And Means Build Back Better Bill Is A First Step Toward A Fairer Tax Code Center For American Progress

Be Aware Of Current Laws On Estate Taxes Successful Farming

What S Happening With The U S Estate And Gift Tax O Sullivan Estate Lawyers Toronto On

Estate Taxes Are A Threat To Family Farms

Income Tax Challenges And Smart Planning For Irrevocable Trusts 1

Build Back Better Act Gift And Estate Tax Changes Davis Wright Tremaine

No Expected Change In The Estate Tax Exemption For 2022 Under The Build Back Better Legislation

Richard Neal Says Biden Inheritance Tax Plan Is Short Of House Votes Bloomberg

No Expected Estate Tax Exemption Increase Under The Build Back Better Legislation

Lifetime Estate And Gift Tax Exemption Will Hit 12 92 Million In 2023

2022 Taxes 8 Things To Know Now Charles Schwab

It May Be Time To Start Worrying About The Estate Tax The New York Times